All of us at Whiteside & Simms CPA, LLC hope you and your family are safe during this unprecedented time in our country. Our hearts go out to you, your business, your employees and your family.

We have been working nonstop to gather all the REAL and ACCURATE information from our SBA Lending Partners, the AICPA, Small Business Administration and other government agencies regarding the SBA Care Act – Payroll Production Program (PPP Loan).

If you are interested in filing for an SBA PPP Loan, SBA EIDL, USDA or other loan or grant programs available, we would love the opportunity to assist you with your applications or advise you on the best course of action. There is plenty of misinformation being passed around, so we are working around the clock to stay up to date on the most current information and the best approach to ease the financial burden this is having on you and your business. Below, you will find the most up to date information available regarding the Coronavirus Relief Programs for Businesses:

PAYCHECK PROTECTION PROGRAM (PPP) – BUSINESSES WITH PAYROLL

The programs and initiatives in the Coronavirus Aid, Relief, and Economic Security (CARES) Act recently passed by Congress are intended to assist business owners with their imminent business needs. When implemented, there will be many new resources available for small businesses, as well as certain non-profits and other employers. This guide provides information about the major programs and initiatives that will soon be available from the Small Business Administration (SBA) as well as additional tax provisions outside the scope of SBA.

The Paycheck Protection Program (PPP) authorizes up to $349 billion in forgivable loans for small businesses to pay their employees during the COVID-19 crisis. PPP loans will provide cashflow assistance through 100% federally guaranteed loans to employers who maintain their payroll during the coronavirus emergency. Loans will be forgiven as long as:

- The loan proceeds are used to cover payroll costs, and most mortgage interest, rent, and utility costs over the 8-week period after the loan is made; and

- Employee and compensation levels are maintained.

Small businesses and other eligible entities will be able to apply if they were harmed by COVID-19 between February 15, 2020 and June 30, 2020. This program would be retroactive to February 15, 2020, in order to help bring workers who may have already been laid off back onto payrolls. Loans are available through June 30, 2020.

- Applying for the PPP Loan

Applications accepted through June 30, 2020, or while funding is available.

- Starting April 3, 2020, small businesses can apply for and receive loans to cover their payroll and other certain expenses through existing SBA lenders. This means you apply for the PPP Loan through your existing bank and banking relationship. As of today, several banks have delayed the process of accepting applications. Check with your bank our Whiteside & Simms regarding the status of your bank and the loan process.

- Starting April 10, 2020, independent contractors and self-employed individuals can apply.

Applicants must complete the PPP loan application and submit supporting documentation. The loan application is available online at:

www.sba.gov/sites/default/files/2020-03/Borrower Paycheck Protection Program Application_0.pdf

or through your banking relationship. Applicants are advised to prepare the following supporting documentation to support your application:

- Articles of Incorporation, Articles of Organization, By-Laws and any Operating agreements.

- Payroll Reports for 2019 and 2020 Year

to Date showing the following by employee and/or officers and other information

needed:

- Gross Wages Paid.

- Paid Time off and Vacation.

- Documentation for Group Health Insurance Premiums Paid.

- Documentation supporting Company Retirement Benefits paid (company match or SEP).

- Pay for family medical leave.

- State and local taxes paid (For Louisiana LA Dept of Labor SUTA Reports).

- 2019 Quarterly Forms 941 or 2019 Annual Form 944.

- 2016 to 2018 Business Tax Returns (IRS Forms 1120, 1120-S or 1065). If business is a disregarded entity (single member LLC or sole proprietor) enclose 2016 – 2018 Form 1040 Individual Tax Return and all schedules.

- 2019 Balance Sheet and Profit & Loss statement for business entity.

- If you have received proceeds in 2020 from an SBA Economic Injury Loan since 1/31/2020 you need to provide documentation of the loan amount and how the loan amount was determined.

2. Forgiveness determination (Done after loan is completed and funds received):

As discussed above, loan forgiveness of all or a portion of the loan will be subject to determination at a later date based on information that will be provided by the SBA. As of today, here is a list of the items the SBA has confirmed they will want. This list is not complete and will be revised.

- Quarterly IRS Payroll Tax Returns for the following dates:

- 3/31/2019 and 6/30/2019

- 3/31/2020 and 6/30/2020

- Documentation in the form of canceled checks, payment receipts or invoices and bank statements showing the following payments from 2/15/2020 through 6/30/220

- Mortgage Interest

- Rent Payment

- Utilities (Including Gas, Electric, Water, Internet, Telephone, Cell Phone)

- Businesses that qualify:

- Business and entities in operation on or before 2/15/2020.

- Small business concerns, as well as any business concern, a 501(c)(3) nonprofit organization, a 501(c)(19)veterans organization, or Tribal business concern described in section 31(b)(2)(C) that has fewer than 500employees, or the applicable size standard in number of employees for the North American Industry Classification.

- Individuals who operate a sole proprietorship or as an independent contractor and eligible self-employed individuals.

- Any business that employs less than 500 employees per location that is in the hospitality or food service business.

4. How is Loan Amount Determined?

Depending on your business’s situation, the loan size will be calculated in different ways (see below). The maximum loan size is always $10 million.

- If you were in business February 15, 2019 – June 30, 2019: Your max loan is equal to 250 percent of your average monthly payroll costs during that time period. If your business employs seasonal workers, you can opt to choose March 1, 2019 as your time period start date.

- If you were not in business between February 15, 2019 – June 30, 2019: Your max loan is equal to 250 percent of your average monthly payroll costs between January 1, 2020 and February 29, 2020.

- If you took out an Economic Injury Disaster Loan (EIDL) between February 15, 2020 and June 30, 2020 and you want to refinance that loan into a PPP loan, you would add the outstanding loan amount to the payroll sum.

5. What is considered payroll and what is not considered payroll?

- Salary, wages, commissions, or tips (capped at $100,000 on an annualized basis for each employee INCLUDING OWNERS) is considered payroll.

- Employee benefits including costs for vacation, parental, family, medical, or sick leave; allowance for separation or dismissal; payments required for the provisions of group health care benefits including insurance premiums; and payment of any retirement benefit is considered payroll.

- State and Local Taxes for payments to Unemployment is considered payroll.

- Items that are NOT payroll are:

- Employee/owner compensation over $100,000 annualized

- Company portion of FICA and Medicare Taxes (those will be a credit on Form 941 when filed).

- Compensation for employees who reside outside the USA.

- Qualified sick and family leave paid under the Families First Cornavirus Response Act.

6. Uses of Loan Proceeds

- Payroll (as outlined above)

- Costs related to the continuation of group health care benefits during periods of paid sick, medical, or family leave, and insurance premiums

- Employee salaries, commissions, or similar compensations (see exclusions above)

- Payments of interest on any mortgage obligation (which shall not include any prepayment of or payment of principal on a mortgage obligation)

- Rent (including rent under a lease agreement) Payroll (as outlined above)

- Utilities

- Interest on any other debt obligations that were incurred before the covered period

7. Other Items

- Size of Loan: Loans can be for up to two months of your average monthly payroll costs from the last year plus an additional 25% of that amount. That amount is subject to a $10 million cap. If you are a seasonal or new business, you will use different applicable time periods for your calculation. Payroll costs will be capped at $100,000 annualized for each employee.

- Interest Rate: .05% fixed rate.

- When do I start Paying- All payments are deferred for 6 months but interest will accrue over period and loan is due and full in 2 years. There are no prepayment penalties or fees.

- Can I get more than one PPP Loan – No each ENTITY is limited to one PPP Loan BUT if you own multiple entities with different Tax ID Numbers each entity can get a loan.

- Collateral – None Required and no personal guarantee.

- Does loan coordinate with SBA Existing Loan Programs? – Borrowers may apply for PPP loans and other SBA financial assistance, including Economic Injury Disaster Loans (EIDLs), 7(a) loans, 504 loans, and microloans, and also receive investment capital from Small Business Investment Corporations (SBICs). However, you cannot use your PPP loan for the same purpose as your other SBA loan(s). For example, if you use your PPP to cover payroll for the 8-week covered period, you cannot use a different SBA loan product for payroll for those same costs in that period, although you could use it for payroll not during that period or for different workers.

- How do I get forgiveness of my PPP Loan? You must apply through your lender for forgiveness on your loan. In this application, you must include:

- Documentation verifying the number of employees on payroll, payroll rates, IRS tax filings and state income, payroll and unemployment insurance filings.

- Documentation verifying payments on covered mortgage obligations, lease obligations and utilities.

- Certification from business owner that documentation is true and accurate, and the amount being forgiven is true and that the amounts was used in accordance with the program’s guidelines for use.

- How is forgiveness amount calculated? You will owe money when your loan is due if you use the loan amount for anything other than payroll costs, mortgage interest, rent, and utilities payments over the 8 weeks after getting the loan. Due to likely high subscription, it is anticipated that not more than 25% of the forgiven amount may be for non-payroll costs.

You will also owe money if you do not maintain your staff and payroll.

- Number of Staff: Your loan forgiveness will be reduced if you decrease your full-time employee headcount.

- Level of Payroll: Your loan forgiveness will also be reduced if you decrease salaries and wages by more than 25% for any employee that made less than $100,000 annualized in 2019.

- Re-Hiring: You have until June 30, 2020 to restore your full-time employment and salary levels for any changes made between February 15, 2020 and April 26, 2020.

- What do I need to Certify?

As part of your loan you need to certify in good faith that

- Current economic uncertainty makes the loan necessary to support your ongoing operations.

- The fund will be used to retain workers and maintain payroll or to make mortgage, lease and utility payments. You have not and will not receive another loan under this program for this business.

- You will provide lender documentation that verifies the number of full-time equivalent employees on payroll, the dollar amounts of payroll costs, covered mortgage interest payments, covered rent payments and covered utilities for the eight weeks after receiving the loan.

- Loan forgiveness will be provided for the some of all documented payroll, covered mortgage interest payments, covered rent payments and covered utilities and not more than 25% of forgiven amount will be for non-payroll costs.

- All the All the information you provided in your application and in all supporting documents and forms is true and accurate. Knowingly making a false statement to get a loan under this program is punishable by law.

- You acknowledge that the lender will calculate the eligible loan amount using the tax documents you submitted. You affirm that the tax documents are identical to those you submitted to the IRS. And you also understand, acknowledge, and agree that the lender can share the tax information with the SBA’s authorized representatives, including authorized representatives of the SBA Office of Inspector General, for the purpose of compliance with SBA Loan Program Requirements and all SBA reviews.

PAYCHECK PROTECTION PROGRAM (PPP) – BUSINESSES WITHOUT PAYROLL

Starting April 10, 2020, independent contractors and self-employed individuals can apply for assistance similar to businesses with payroll.

We are currently awaiting additional guidance regarding this program and expect to have more information early next week. However, we are advising our clients to prepare the following supporting documentation to support your application:

- Articles of Incorporation, Articles of Organization, By-Laws and any Operating agreements.

- 2016 to 2018 Individual Tax Returns with all schedules

- 2016 to 2018 Business Tax Returns if applicable

- 2019 Balance Sheet and Profit & Loss statement for business entity if available

We will provide more information as it is released.

SBA ECONOMIC INJURY DISASTER LOAN PROGRAM

The SBA Economic Injury Disaster Loan Program incorporates a traditional U.S. Small Business Administration loan with increased eligibility for businesses and nonprofits no more than 500 employees, as long as the nonprofit is not receiving Medicaid funds.

- Small businesses have the opportunity to apply for an immediate advance of up to $10,000 to small businesses and private non-profits harmed by COVID-19 within three days of applying for an SBA Economic Injury Disaster Loan (EIDL).

- To access the advance, you first apply for an EIDL and then request the advance.

- The advance does not need to be repaid under any circumstance, and may be used to keep employees on payroll, to pay for sick leave, meet increased production costs due to supply chain disruptions, or pay business obligations, including debts, rent and mortgage payments.

- Economic Injury Disaster Loan Program Details:

EIDL applications are handled directly through the SBA and NOT through the bank.

- Loan Size – Up to $2,000,000. Small businesses have the opportunity to apply for an immediate advancement of $10,000, which, according to the SBA, will be made available within three days of applying for the loan.

- Eligibility – Small businesses and non-profits affected by the coronavirus in presidential and SBA-declared disaster areas (list is updated regularly).

- Interest Rate – 2.75% for non-profits and 3.75% for small businesses.

- Loan Term – Up to 30 years.

- Usage – Accounts Payable, Fixed Debt and other operating expenses

- Documentation – Most recent tax returns, a personal financial statement, and a schedule of liabilities that lists all current debts. Traditionally EIDL loans would require a personal lien such as on a home. In this case, personal guarantees have been modified and sometimes eliminated.

- How to apply – Contact Jason Simms or Bates Whiteside at Whiteside & Simms CPA LLC to walk you through the process.

2. Other Information regarding EIDL Loans:

- Loan uses EIDLs are lower interest loans of up to $2 million, with principal and interest deferment at the Administrator’s discretion, that are available to pay for expenses that could have been met had the disaster not occurred, including payroll and other operating expenses.

Louisiana Loan Portfolio Guaranty Program (“LPGP”) in Response to COVID-19

The Louisiana Loan Portfolio Guaranty Program, or LPGP, is a partnership of Louisiana Economic Development (LED), which will provide a loan guaranty fund; the Louisiana Bankers Association (LBA), whose participating members will offer the loans; and the Louisiana Public Facilities Authority (LPFA), which will administer the program.

The purpose of the LPGP is to provide loans to Louisiana small businesses in response to COVID-19. At this time, LED recognizes small business needs are immediate, and if there isn’t a timely response, the State risks losing a foundational element of its economy. In collaboration with the LBA and LPFA, LED has worked with the banking community to provide access to capital to small companies that may experience (have experienced) a sudden drop in revenues due to lost business caused by the COVID-19 pandemic. The State through LED is guaranteeing a portion of each participating bank’s loan.

The LPGP will supply capital to create a loan guaranty fund of up to $50 million, in which LED would guarantee 20 percent of the pool allocated to each participating bank.

Each bank will be responsible for reviewing, issuing, securing collateral, if applicable, and collecting, under standard banking practices, loans of up to $100,000 per applicant and any affiliates. All small businesses employing under 100 workers are eligible, including day cares, farmers and fishermen and we especially encourage main street small businesses, e.g., restaurants. Suggested uses for the loan are to maintain employee payroll for an 8-week period at payroll levels at the time of application for the loan, as well as to maintain continuance of operations within COVID-19 executive orders, proclamations, and relevant state agency guidance.

The repayment period would be at least one year, but could be longer depending on business functionality during the length of the emergency period and would be anticipated to be no more than 5 years.

Rate would be fixed up to 3.5 percent (lower rates subject to lending institution).

First six months would bear no interest; AND no payment would be due for the first 6 months of the loan.

An acceptable loan amount would be tied to pre-COVID 19 employment and functionality of business expenses pre-COVID 19, as evaluated by the lending institutions.

Unless otherwise engaging in essential activity as provided by Proclamation Number 33 JBE 2020 (https://gov.louisiana.gov/assets/Proclamations/2020/modified/33-JBE-2020-PublicHealth-Emergency-COVID.pdf), ineligible businesses are those engaged in gaming, non-profit organizations, real estate developers, pawn shops, pay-day loans, lending and investment concerns, or speculative activities.

Banks to provide the documentation of a streamlined application.

Periodic reporting including, but not limited to, compliance with the borrower’s obligations, will be required on the loan.

Internal Revenue Service Operational Changes

During Coronavirus Pandemic, IRS Cuts Taxpayers Some Much Needed Slack. The IRS is actually making a big effort to cut all taxpayers — and that includes the crypto community too — some much needed slack during this unprecedented time. It started when the head of the IRS, Commissioner Chuck Rettig, announced the “People First Initiative.

Haven’t filed a return? The IRS says over 1 million households that haven’t filed tax returns during the last three years are owed refunds, so fill out those returns! Once delinquent returns are filed, taxpayers who owe money should consider an installment agreement or an OIC.

Tax liens and levies are also generally being suspended during this period. A Notice of Federal Tax Lien is normally sent out almost automatically when the IRS is owed taxes, serving as a way to insure by public notice that it will eventually get paid. A levy, on the other hand, involves the IRS actually collecting owed taxes by allowing it to take funds directly from a bank account upon deposit. The fact that the IRS is trying to ease up on both during this time is significant. Even new passport debt certifications when delinquent tax debts exceed $50,000 are on hold too.

New tax audits are on hold too. One exception is when the IRS needs to act right away to protect the government’s interest in preserving the applicable statute of limitations. Usually, the statute of limitations is three years, but that’s not always the case: Here are some rules everyone should know. The IRS will continue to take steps where necessary to protect all applicable statutes of limitations. The IRS may ask taxpayers to extend the statute, or when needed, will issue notices of deficiency.

Here are a few changes the IRS is making to accommodate taxpayer:

- Installment agreements: The IRS is suspending payments due on existing installment agreements from April 1 to July 15, but interest continues to accrue on the balance. New installment agreements for people who cannot pay their balance due continue to be available on the IRS’s website.

- Offers in compromise (OICs): The IRS is extending a number of deadlines related to OICs. Taxpayers have until July 15 to provide additional information the IRS has requested to support a pending OIC. In addition, the IRS will not close any pending OIC request before July 15, 2020, without the taxpayer’s consent. As for OIC payments, taxpayers can suspend all payments on accepted OICs until July 15, 2020, although by law interest will continue to accrue on any unpaid balances. The IRS also will not default an OIC for taxpayers who are delinquent in filing their tax return for tax year 2018. However, taxpayers should file any delinquent 2018 return (and their 2019 return) on or before July 15, 2020.

- Field collection activities: The IRS will suspend any liens and levies (including personal residence seizures) initiated by field revenue officers during this period. Field revenue officers will continue to pursue high-income non-filers and may perform other similar activities. Automatic system liens and levies will be suspended, however.

- Passport certifications to the State Department: The IRS will suspend new passport notifications for “seriously delinquent” taxpayers during this period.

- Private debt collection: The IRS will not forward new delinquent accounts to private debt collectors during this period.

- Field, office, and correspondence audits: New field, office, and correspondence audits will generally not be started during this period except to preserve cases where the statute of limitation is about to expire. In-person meetings are being suspended, but remote examinations may continue.

- Appeals: The IRS Appeals Office is continuing to work its cases but without in-person meetings, using teleconferencing where necessary.

- Telephone support: The IRS continues to answer the Practitioner Priority Service phone line, but due to reduced staffing levels, practitioners could face long wait times.

Louisiana Department of Revenue Operational Changes

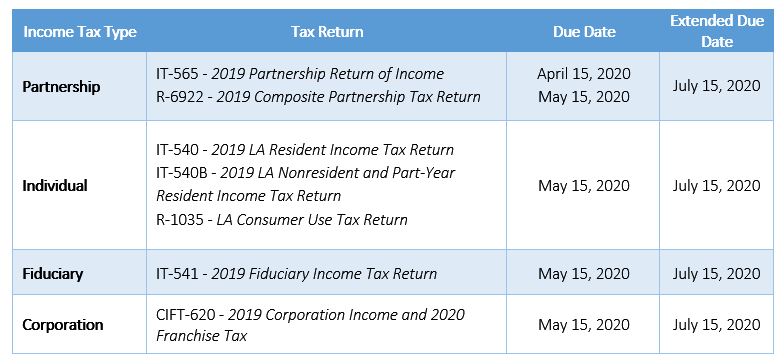

Due to the public health emergency created by the coronavirus pandemic, the Louisiana Department of Revenue (LDR) is extending the deadline for state income taxes to July 15, 2020. The extension applies to Louisiana individual, corporation, fiduciary and partnership income tax returns and payments.

“We recognize that the coronavirus pandemic has caused significant disruptions in the lives of Louisiana citizens,” Secretary of Revenue Kimberly Lewis Robinson said. “We believe providing more time to file and pay their taxes can help to ease the stress they might be feeling during this public health emergency.”

The state filing extension follows the U.S. Treasury Department’s decision to move the federal income tax deadline from April 15 to July 15.

The state filing extension is automatic for eligible taxes and no extension request is necessary. LDR will not apply penalties or interest to any applicable returns or payments submitted by the extended July 15 deadline.

Due to a statewide stay-at-home order issued by Gov. John Bel Edwards, LDR has suspended in-person customer service to help slow the spread of COVID-19. During this public health emergency, LDR recommends all taxpayers take advantage of the online customer service options available on the department’s website, including Louisiana File Online, the state’s free tax filing portal for individual taxpayers.

As the COVID-19 situation continues to evolve, so does Whiteside & Simms, CPA, LLC’s response to the situation. In order to help ensure the safety and wellness of our staff, our clients, and the community at large, we are doing our part to help limit the spread of the disease. Effective Wednesday, March 18th, we are transitioning to a primarily remote working environment.

Whiteside & Simms has a long-standing practice of utilizing technology, tools, and processes that support remote work. For example, all of our team members have laptop computers, and we use cloud-based software, virtual communication tools, and electronic data storage as standard practices. This remote working arrangement will not impact our ability to service clients or continue business operations. However, Whiteside & Simms office are closed to visitors until further notice.

If you have questions or need assistance, please call our main reception line at 504-525-7245.

Our thoughts are with everyone affected by the coronavirus pandemic. If we can help you, please let us know.